Another Big Decline Is Ahead

- Aug 2, 2025

- 9 min read

I have been very bearish on stocks for a long time. Too long! Does that make me wrong? Right, but early? I think too early, but I don't know the answer. What I do know is that I started blogging here in October 2023 and wrote my first blog here on "other stocks" (not cannabis stocks) in March of 2024. That was Get Out Now, and one of the stocks that I was talking about plunged, while the other has gone up a lot.

Unlike cannabis stocks, where I am an expert but never trade them personally, I have a lot of experience with stocks and I do trade them and invest in them. My first stock that I owned was when I was 13, and I did serve as a professional equity investor until I resigned that job in 2006. I am smart enough to know that I can't predict the future, and I am unaware of any human that can do so at least all of the time.

So, why does this CFA write about stocks? While I admit that I can't predict the future, I do thoroughly enjoy thinking about it and sharing my perspective. I started off at Seeking Alpha contributing articles when there was absolutely no pay associated with doing so, writing about regular stocks from early 2007. I enjoyed doing it and became one of the most followed contributors there. I have now 72K followers, but I have been writing from late 2013 until just six months ago exclusively cannabis articles. This year, I have shared several articles on regular stocks:

That is 8 out of 34 articles this year, which is about one per week. Have they been awesome? No, not by the outcomes (remember, I can't predict the future!) or by readership. My average page views for those articles has been 3705 readers. The best article for me this year was one on Tilray Brands (TLRY) in February at 22,154, and my best non-cannabis of the 8 I have published was the one on GDX at 8,245. The average of my 26 cannabis stock articles has been 4022, while the 8 non-cannabis ones has averaged 2674. One of my cannabis articles (4%), the last one I wrote, has fewer than 1000 views, while two (25%) of my non-cannabis articles have had that few of readers.

So, stocks have continued to rally, but things may have changed yesterday and this week, so I am going to refresh my views on stocks and bonds today.

What Is Going On

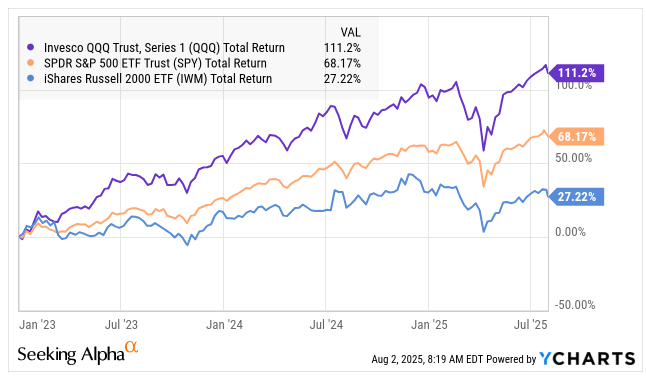

Stocks fell Friday and for the week, but they are up in 2025, especially from the early April lows. Here is the year-to-date chart of the S&P 500 (SPY), the NASDAQ-100 (QQQ) and the Russell 2000 (IWM):

Small-Caps, were up again after dropping sharply in early April, but they fell short of their peak early in the year. SPY and QQQ posted new all-time highs. In early April, just before I called out the Magnificent 7 as being not so magnificent and discussed the problems America faces, Tariff Tuesday trampled stocks. Many bought the dip. Even I wrote a bullish article on the market that same day (on IWM). The market did recover, going higher than I had expected.

Looking back from the end of 2022 gives a better perspective:

Since the end of 2022, QQQ has more than doubled, while the S&P 500 has increased 68%. Small-Caps have rallied but by substantially less. The numbers are similar in direction but with much bigger returns since the last bear market ended in 2009:

There is no denying that the bull market has been very powerful. The main risk right now is the high level of debt that the U.S has currently.4 months ago, in the "Not So Magnificent" article, I shared that it was currently at $36 trillion. It is now $36.8 trillion. Who caused this? Trump or Biden? Yes! Trump cut taxes and Biden hiked spending (due to the pandemic mainly).

The U.S dollar has been weakening recently, with the US Dollar Index falling 10% since mid-January. As big of a move in such a short period of time as this is, the 10-year perspective shows that it is actually stronger today than a decade ago:

The debt, which needs to be refinanced regularly, is weighing on interest-rates. The Federal Reserve Board has cut the overnight Fed Funds rate by 1% to a range of 4.25% to 4.50% over the past year. I wrote about this on March 19th, when they were meeting and no rate change was expected. The Fed cut rates three times, with the first cut was ahead of the elections (0.5%) and then another one right after (0.25%) and a final one in January. They weren't expected to change rates when they met last week, and they did not do so.

Rates for U.S. Treasury securities fell a lot last week, but they are still up a lot over the past year for longer maturities:

Despite the short-term rates coming down sharply, yields on the 5-year and out are up a lot. Are rates low or high? As I have been saying, they are high relative to the very low rates during the last recession and after the pandemic, but they are pretty low compared to the 1980s, when inflation was a big problem.

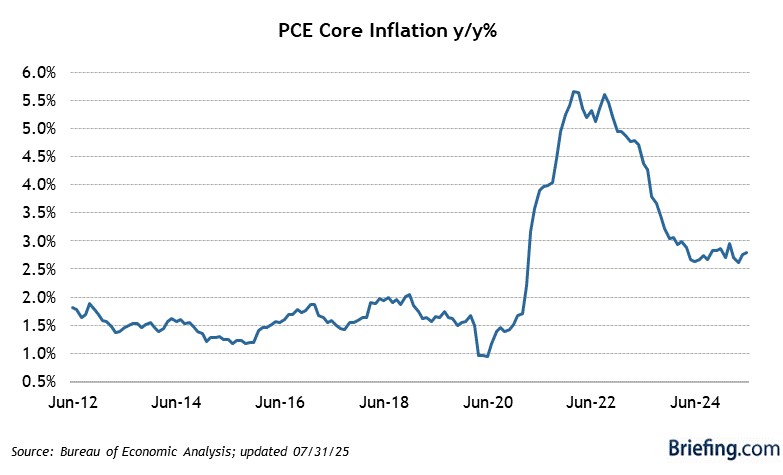

Inflation was a big problem during the pandemic, and it has come down, but it remains a tremendous challenge. The Federal Reserve Board has a goal of 2% or lower inflation as measured by the PCE, which was released on 7/31 for June and met expectations. Inflation by this measure, is down from where it was but still above the Fed target and the level of inflation over the years ahead of the pandemic:

There is a lot of drama going on in Washington, DC. The President is fed up with the head of the Federal Reserve Board and wants him to lower rates or leave. Another FOMC member left the Federal Reserve this week.

Another piece of big news this week was the monthly employment report, which came out 8/1 and was a little weaker than expected. The big story was the dramatic revisions to prior months. The President fired the commissioner from the Bureau of Labor & Statistics, blaming her for manipulating the numbers for political reasons. Seems absurd to me! More importantly, it seems absurd to several people who are conservative politically and understand the process. From my perspective, unemployment seems rather low

So, there is a lot going on right now, with the massive debt, Fed policy and the whole tariff situation. Yet, stocks have been doing well, making new highs after the early April collapse.

What Could Happen

One thing that could happen is that everything works out and the bull market persists. I can't make that argument, but there is a chance.

The President and some others, including two FOMC members who voted this week to reduce rates, want lower interest rates, and I understand that sentiment. It is no surprise that the President wants lower rates, though, as most debtors would like their borrowing costs to be lower. The interest that the U.S. is paying is massive! Also, while the economy has seemed strong in many ways, I think it has weakened, and lower rates traditionally help the weak economy. Still, cutting short-term rates (Fed Funds) has not lowered rates. In fact, cutting them further may cause long-term rates to rise more! Why? Fear of inflation.

I am not at the point of predicting with confidence that we will have massive inflation, but I have discussed how there are ways to protect against it through Treasury Inflation-Protected Securities (TIPS). Most recently, I discussed it here in mid-July as a way to protect against inflation.

If we end up with inflation, we will end up with higher rates. We may end up without inflation but higher rates too. The debt is a very large and unusual challenge for our country. I think that higher rates could cause a lot of problems for the economy and for investments.

What You Should Do (and Why)

My outlook has not changed much. I am still very cautious on stocks and concerned that bonds could weaken too. I have written a lot here already and am not going to go into depth discussing the big investment themes, but I will provide fresh charts. The themes are:

Avoid stocks, especially Technology and Financials and the Magnificent 7

Avoid gold and gold miners

Favor cash and Treasury Inflation-Protected Securities (TIPS)

SELL STOCKS

I shared some stock charts above, and in the past I have discussed my view that the pandemic lows could be eclipsed, which I continue to believe could happen. Again, I don't know the future!

Looking at Financials and looking back to how poorly they performed in 2008 and 2009, it is important to remember that the crisis then was especially hard on the banks. I am not yet as negative on the Financials as I am on Technology, but I think a look at the big ETF Financial Select Sector SPDR Fund (XLF) shows the potential for big downside due to the big run-up:

It is not up as much as SPY, but it is up a lot! I was short effectively, but I removed my short very profitably on 8/1.

What I really don't like are the Magnificent 7, which I have discussed a lot here. There is nothing wrong with the companies, but their stocks have run up so much and are a huge percentage of the NASDAQ-100 and the S&P 500. Here is their YTD performance:

Note that 4 of the 7 are down. Hmm. The worst is Tesla (TSLA), which is the one where something may be wrong besides the valuation of its stock. I have no position directly betting against it now, but I may in the near future. Apple (AAPL) is down almost as much, while Amazon (AMZN) is down a bit and Alphabet (GOOG) is down just slightly. Again, the S&P 500 has returned 6.7%. Three stocks are up a lot more, including leader NVIDIA (NVDA), Meta Platforms (META) and Microsoft (MSFT). I am betting against META through an inverse ETF, METD. I put this position on Thursday after it surged. I am also betting against NVDA through an inverse ETF, NVD. Finally, I am betting against QQQ through SQQQ.

I think a look at the chart from the end of 2022 drives home the point of how much these stocks are up. Remember, QQQ has returned 111.2% since then.

All but AAPL are up more than QQQ, but AAPL has returned almost as much as SPY.

AVOID GOLD

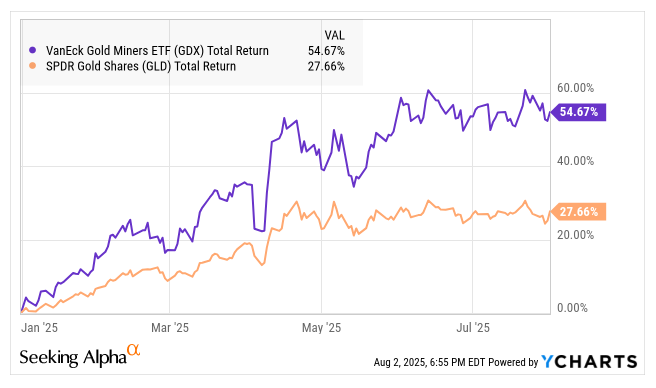

Gold has been doing well for a lot of reasons. My view is that it has done too well. Some fear inflation, and gold has traditionally outpaced inflation. Also, it can be good for disruptive times. Finally, central banks have been boosting positions. Here is a chart of gold as measured by SPDR Gold Shares (GLD) and gold miners as measured by the VanEck Gold Miners ETF (GDX) for 2025:

Both of these have outpaced stocks by far, with gold prices setting a record this year. Looking at the action for the past 10 years, they have been very strong:

I have substantial exposure to an inverse ETF for gold miners, GDXD. I have traded this very actively and have made money despite not being so right since my Seeking Alpha piece on May 10th, when GDX was at about $48.

CHOOSE CASH OR TIPS

I have written a lot about TIPS on this blog and a few times at Seeking Alpha. I like investments that make a lot of sense but aren't so popular with investors. Here are the returns of three very different ETFs that I have discussed before, iShares 0-5 Year TIPS Bond ETF (STIP), iShares TIPS Bond ETF (TIP) and PIMCO 15+ Year US TIPS Index ETF (LTPZ), along with cash:

The long-dated LTPZ has essentially matched cash, while the others have far outpaced it. I like to compared LTPZ to iShares 20+ Year Treasury Bond ETF (TLT). They both have long durations, but one is negatively impacted by inflation (TLT) and one may be protected (LTPZ). Here is the price return (rather than total return) for the past ten years:

Here is the past decade of action for the TIPS ETFs:

LTPZ has underperformed cash, but not how well it did in 2020 and 2021. It did too well, and this has resulted in a tough exit for many. I say take the other side!

In the inflation article I linked above (and here too!), I explained more about TIPS and why I like cash so much for this environment.

Conclusion

Again, I do not know the future, but I am smart enough to assess it. I think that a lot of folks are making a big mistake with their investments (chasing gold, buying the dips, expecting the Fed to ease), and it could get very nasty. I have shared my exposures, and I understand that everyone is different. For some who agree with me, the right conclusion is to reduce exposures. For some, shorting certain securities may make sense. I have disclosed my own exposure to leveraged ETFs, and everyone should understand that these are very risky and require a lot of attention and are not for everyone.

Comments